Log in

Home

Our Services

Our System

Our Resources

About Us

Signature Training

Contact Us

Mon - Fri: 7:00AM - 5:00PM CST

Latest News

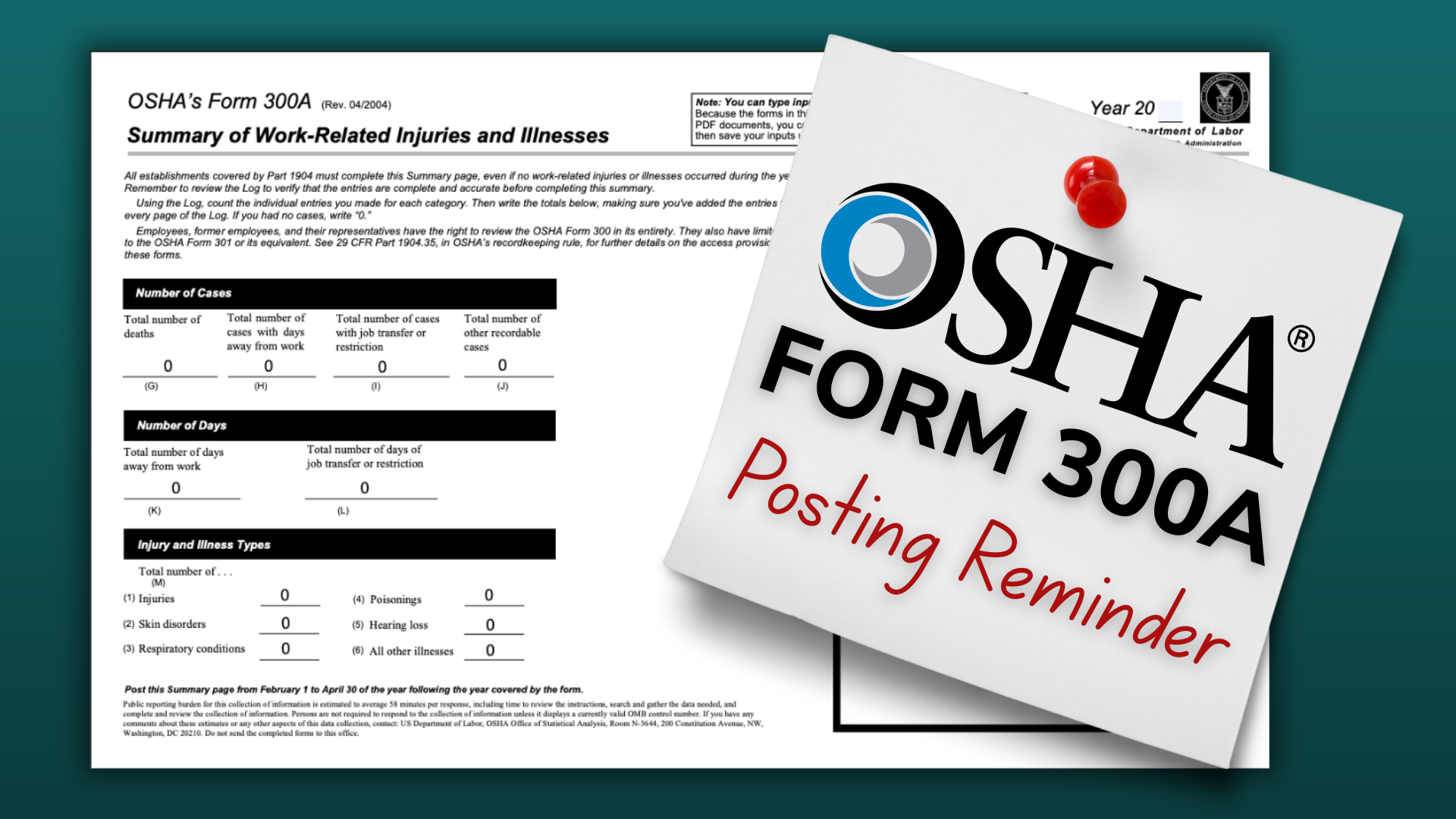

OSHA 2025 Injury & Illness Posting Reminder

Post your OSHA Form 300A February 1 - April 30

January 23, 2026

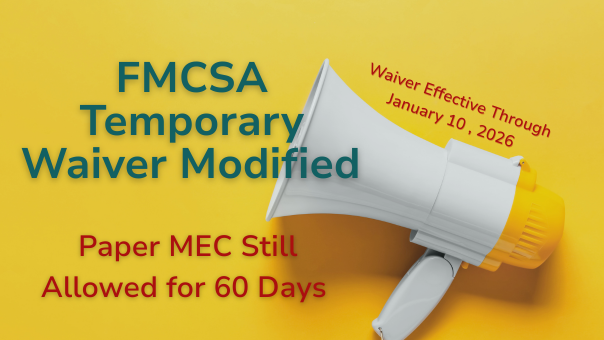

FMCSA Re-Issues Temporary Waiver for Medical Certification Documentation

The waiver is effective January 11, 2026, through April 10, 2026.

January 08, 2026

Welcoming New Leaders to the Asmark Team

We're excited to welcome Ron Crumbaker and Brandon Huff!

December 17, 2025

Subscribe to Our Newsletter

FMCSA Still Allows Paper MECs for 60 Days

The re-issued waiver is in effect October 13, 2025 through January 10, 2026.

October 10, 2025